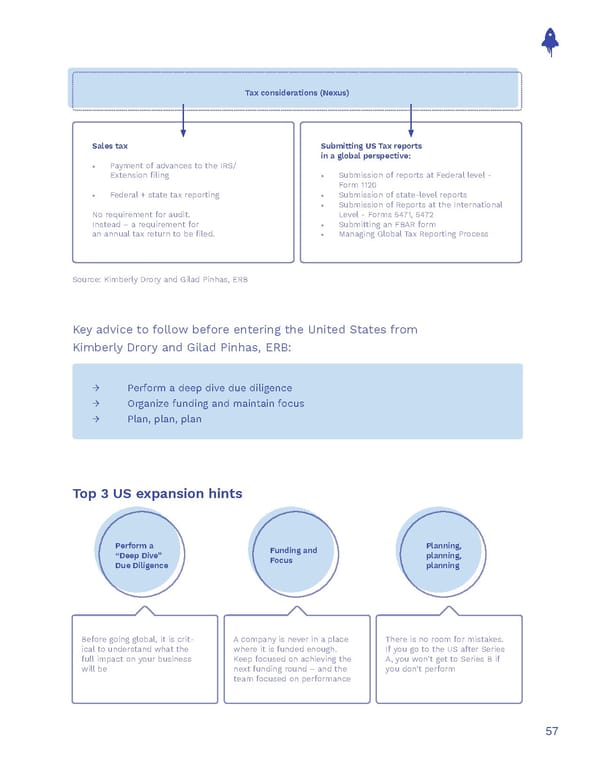

Tax considerations (Nexus) Sales tax Submitting US Tax reports in a global perspective: • Payment of advances to the IRS/ Extension filing • Submission of reports at Federal level - Form 1120 • Federal + state tax reporting • Submission of state-level reports • Submission of Reports at the International No requirement for audit. Level - Forms 5471, 5472 Instead – a requirement for • Submitting an FBAR form an annual tax return to be filed. • Managing Global Tax Reporting Process Source: Kimberly Drory and Gilad Pinhas, ERB Key advice to follow before entering the United States from Kimberly Drory and Gilad Pinhas, ERB: → Perform a deep dive due diligence → Organize funding and maintain focus → Plan, plan, plan Top 3 US expansion hints Perform a Funding and Planning, “Deep Dive” Focus planning, Due Diligence planning Before going global, it is crit- A company is never in a place There is no room for mistakes. ical to understand what the where it is funded enough. If you go to the US after Series full impact on your business Keep focused on achieving the A, you won’t get to Series B if will be next funding round – and the you don’t perform team focused on performance 57

The Sales Operations Playbook Page 56 Page 58

The Sales Operations Playbook Page 56 Page 58