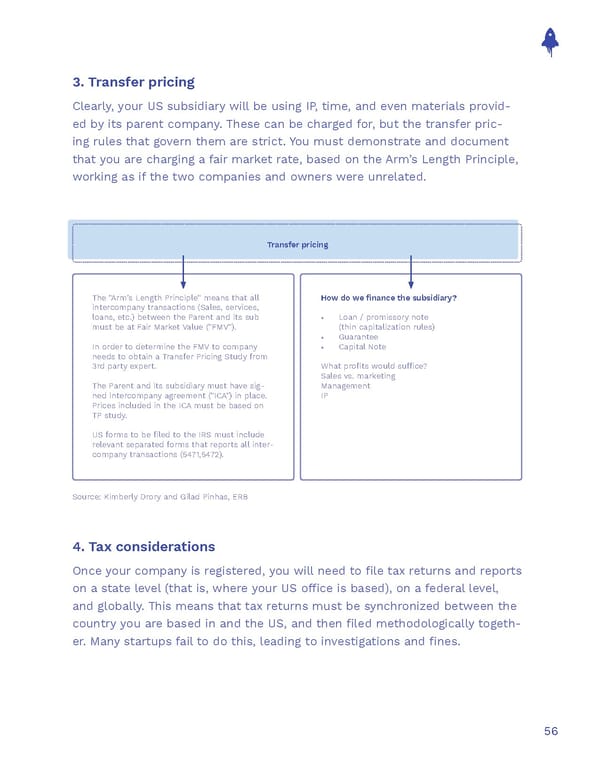

3. Transfer pricing Clearly, your US subsidiary will be using IP, time, and even materials provid- ed by its parent company. These can be charged for, but the transfer pric- ing rules that govern them are strict. You must demonstrate and document that you are charging a fair market rate, based on the Arm’s Length Principle, working as if the two companies and owners were unrelated. Transfer pricing The "Arm's Length Principle" means that all How do we finance the subsidiary? intercompany transactions (Sales, services, loans, etc.) between the Parent and its sub • Loan / promissory note must be at Fair Market Value ("FMV"). (thin capitalization rules) • Guarantee In order to determine the FMV to company • Capital Note needs to obtain a Transfer Pricing Study from 3rd party expert. What profits would suffice? Sales vs. marketing The Parent and its subsidiary must have sig- Management ned intercompany agreement ("ICA") in place. IP Prices included in the ICA must be based on TP study. US forms to be filed to the IRS must include relevant separated forms that reports all inter- company transactions (5471,5472). Source: Kimberly Drory and Gilad Pinhas, ERB 4. Tax considerations Once your company is registered, you will need to file tax returns and reports on a state level (that is, where your US office is based), on a federal level, and globally. This means that tax returns must be synchronized between the country you are based in and the US, and then filed methodologically togeth- er. Many startups fail to do this, leading to investigations and fines. 56

The Sales Operations Playbook Page 55 Page 57

The Sales Operations Playbook Page 55 Page 57