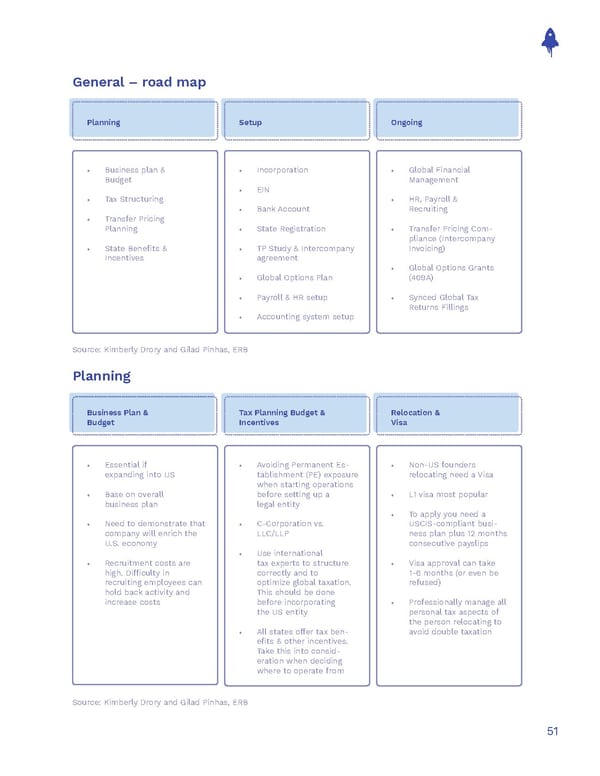

General – road map Planning Setup Ongoing • Business plan & • Incorporation • Global Financial Budget Management • EIN • Tax Structuring • HR, Payroll & • Bank Account Recruiting • Transfer Pricing Planning • State Registration • Transfer Pricing Com- pliance (Intercompany • State Benefits & • TP Study & Intercompany Invoicing) Incentives agreement • Global Options Grants • Global Options Plan (409A) • Payroll & HR setup • Synced Global Tax Returns Fillings • Accounting system setup Source: Kimberly Drory and Gilad Pinhas, ERB Planning Business Plan & Tax Planning Budget & Relocation & Budget Incentives Visa • Essential if • Avoiding Permanent Es- • Non-US founders expanding into US tablishment (PE) exposure relocating need a Visa when starting operations • Base on overall before setting up a • L1 visa most popular business plan legal entity • To apply you need a • Need to demonstrate that • C-Corporation vs. USCIS-compliant busi- company will enrich the LLC/LLP ness plan plus 12 months U.S. economy consecutive payslips • Use international • Recruitment costs are tax experts to structure • Visa approval can take high. Difficulty in correctly and to 1-6 months (or even be recruiting employees can optimize global taxation. refused) hold back activity and This should be done increase costs before incorporating • Professionally manage all the US entity personal tax aspects of the person relocating to • All states offer tax ben- avoid double taxation efits & other incentives. Take this into consid- eration when deciding where to operate from Source: Kimberly Drory and Gilad Pinhas, ERB 51

The Sales Operations Playbook Page 50 Page 52

The Sales Operations Playbook Page 50 Page 52