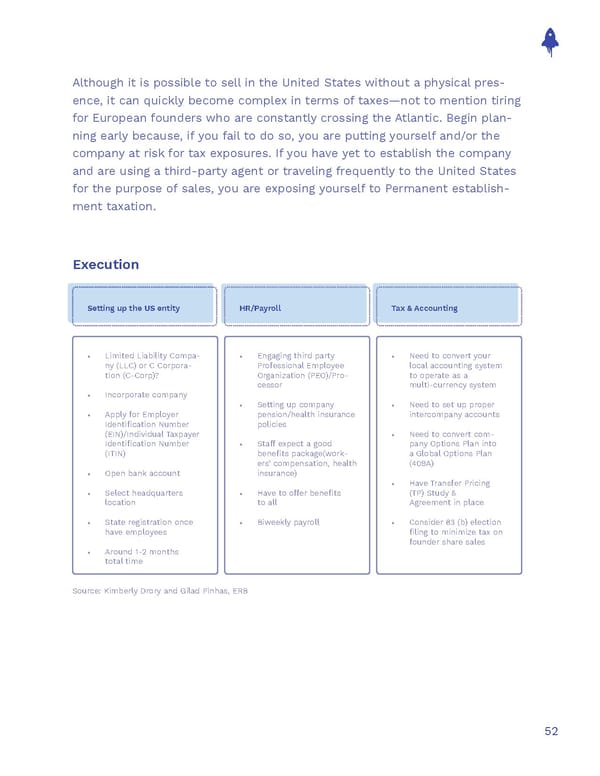

Although it is possible to sell in the United States without a physical pres- ence, it can quickly become complex in terms of taxes—not to mention tiring for European founders who are constantly crossing the Atlantic. Begin plan- ning early because, if you fail to do so, you are putting yourself and/or the company at risk for tax exposures. If you have yet to establish the company and are using a third-party agent or traveling frequently to the United States for the purpose of sales, you are exposing yourself to Permanent establish- ment taxation. Execution Setting up the US entity HR/Payroll Tax & Accounting • Limited Liability Compa- • Engaging third party • Need to convert your ny (LLC) or C Corpora- Professional Employee local accounting system tion (C-Corp)? Organization (PEO)/Pro- to operate as a cessor multi-currency system • Incorporate company • Setting up company • Need to set up proper • Apply for Employer pension/health insurance intercompany accounts Identification Number policies (EIN)/Individual Taxpayer • Need to convert com- Identification Number • Staff expect a good pany Options Plan into (ITIN) benefits package(work- a Global Options Plan ers’ compensation, health (409A) • Open bank account insurance) • Have Transfer Pricing • Select headquarters • Have to offer benefits (TP) Study & location to all Agreement in place • State registration once • Biweekly payroll • Consider 83 (b) election have employees filing to minimize tax on founder share sales • Around 1-2 months total time Source: Kimberly Drory and Gilad Pinhas, ERB 52

The Sales Operations Playbook Page 51 Page 53

The Sales Operations Playbook Page 51 Page 53