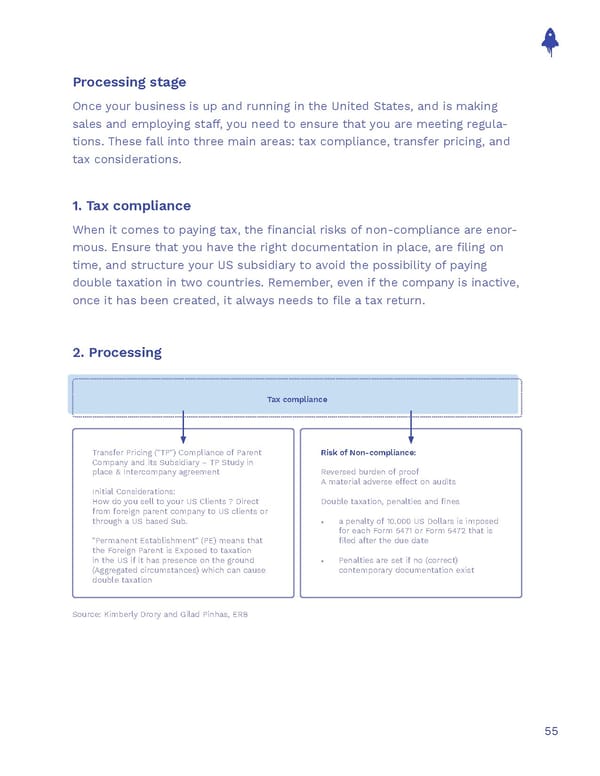

Processing stage Once your business is up and running in the United States, and is making sales and employing staff, you need to ensure that you are meeting regula- tions. These fall into three main areas: tax compliance, transfer pricing, and tax considerations. 1. Tax compliance When it comes to paying tax, the financial risks of non-compliance are enor- mous. Ensure that you have the right documentation in place, are filing on time, and structure your US subsidiary to avoid the possibility of paying double taxation in two countries. Remember, even if the company is inactive, once it has been created, it always needs to file a tax return. 2. Processing Tax compliance Transfer Pricing ("TP") Compliance of Parent Risk of Non-compliance: Company and its Subsidiary – TP Study in place & Intercompany agreement Reversed burden of proof A material adverse effect on audits Initial Considerations: How do you sell to your US Clients ? Direct Double taxation, penalties and fines from foreign parent company to US clients or through a US based Sub. • a penalty of 10.000 US Dollars is imposed for each Form 5471 or Form 5472 that is "Permanent Establishment" (PE) means that filed after the due date the Foreign Parent is Exposed to taxation in the US if it has presence on the ground • Penalties are set if no (correct) (Aggregated circumstances) which can cause contemporary documentation exist double taxation Source: Kimberly Drory and Gilad Pinhas, ERB 55

The Sales Operations Playbook Page 54 Page 56

The Sales Operations Playbook Page 54 Page 56